Commodities have traditionally played one primary role—hedging against inflation. While this is still an essential function, Belgian investors are increasingly discovering that commodities can serve a broader range of purposes in a modern, diversified portfolio. From enhancing returns to offering protection in times of geopolitical instability, commodities deserve renewed attention in today’s fast-paced markets.

Let’s explore how Belgian traders and investors can integrate commodities tactically—not just as a shield against inflation, but as a proactive instrument to navigate market cycles, mitigate risks, and seize new opportunities.

Rethinking Commodities in a Diversified Strategy

For decades, commodities like gold, oil, and agricultural products were seen largely as “defensive assets.” When inflation surged or equity markets turned volatile, investors would turn to physical assets to preserve purchasing power. While this remains a sound principle, it no longer captures the full scope of what commodities can offer.

Modern Belgian portfolios—particularly those tailored for tactical and strategic allocation—are increasingly multidimensional. They are built not only for preservation but also for growth, resilience, and adaptability. Within this framework, commodities can act as:

- Uncorrelated return drivers

- Hedge vehicles for macro risks

- Short-term speculative instruments

- Tools for thematic or seasonal plays

Each of these roles requires a different mindset and toolset, but together they can significantly enhance portfolio efficiency.

Commodities as Return Enhancers in Belgium’s Low-Yield Climate

Belgium, like much of the Eurozone, has faced prolonged periods of low or negative real interest rates. This has pushed investors to look beyond traditional bonds and savings accounts for meaningful returns.

Commodities can fill this gap. Unlike bonds, which are inherently yield-based, or equities, which are tied to corporate earnings, commodities are driven by supply and demand dynamics that can often move independently of the broader financial system. For example:

- Energy: As economies reopen and infrastructure transitions toward cleaner fuels, energy markets (like crude oil, natural gas, and renewables) offer tactical opportunities for both long- and short-term positions.

- Industrial metals: Copper, lithium, and nickel are essential to green technologies and electric vehicles. Their growing demand isn’t just a long-term trend; it’s a tactical play that Belgian investors can capitalise on today.

- Agricultural commodities: Weather patterns, export bans, and population growth continue to drive volatility and opportunity in grains, coffee, sugar, and other food-related markets.

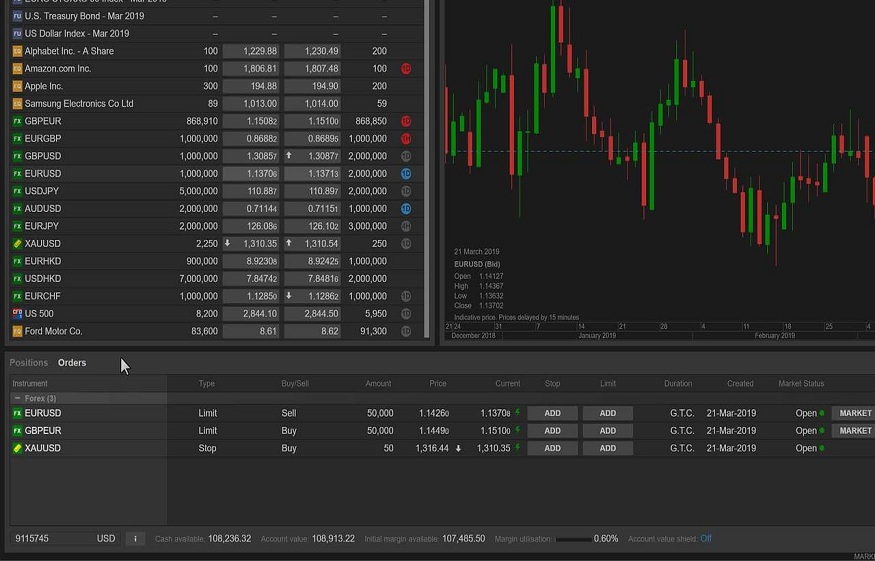

In each of these sectors, Belgian investors can access positions via futures contracts, exchange-traded products (ETPs), or through more comprehensive platforms like SaxoTrader, which allow for tailored exposure to commodity instruments in real-time market conditions.

Strategic Use Cases: Volatility Management and Thematic Investing

While inflation hedging remains a valid reason to hold commodities, investors are now using them more tactically to manage portfolio volatility and express strategic themes.

Volatility Dampeners

Gold and silver continue to offer safe-haven qualities during periods of uncertainty, especially when equities suffer sharp corrections or when geopolitical tensions rise. Allocating even a small portion (5–10%) of a portfolio to precious metals can act as a cushion during turbulent markets—something Belgian investors found useful during recent banking sector unrest and energy shortages across Europe.

Thematic Exposure

Commodities are also an efficient way to play specific themes without investing directly in companies. For example:

- Climate change policy can drive demand for carbon credits, renewable energy inputs, and metals like cobalt.

- De-globalisation and food security concerns can push up agricultural prices.

- Water scarcity could boost demand for water rights and irrigation technologies.

Tactical investors in Belgium can now gain this exposure through structured products, commodity-focused ETFs, or direct trading of contracts, depending on their risk appetite and trading sophistication.

Risks and Considerations

No investment is without risks, and commodities are no exception. They are inherently volatile and can be influenced by factors that are difficult to predict, such as:

- Weather patterns and natural disasters

- Political instability in resource-rich regions

- Technological shifts (e.g., green energy phasing out fossil fuels)

- Currency fluctuations and commodity-specific regulations

For Belgian investors, additional factors such as EU environmental policy, trade agreements, and carbon pricing mechanisms also play a role in shaping commodity market behaviour. This means investors need not only access but also insight—tools and platforms that offer research, technical indicators, and risk management functions.

Integrating Commodities

So, how can Belgian investors tactically incorporate commodities into their portfolios? There’s no one-size-fits-all solution, but here’s a common-sense framework to begin with:

- Core holding for protection: Allocate 5–10% to gold or diversified commodity baskets as a long-term hedge.

- Tactical satellite exposure: Use short-term positions in energy, metals, or agricultural products to capitalise on news, data releases, or seasonal patterns.

- Thematic tilts: Build exposure to ESG-friendly commodities, battery materials, or food security via ETFs or managed strategies.

The key is to ensure commodities complement your broader strategy, rather than dominate it. Diversification remains essential—even within the commodity asset class.

Conclusion

Gone are the days when commodities were considered static, defensive holdings. In the hands of informed investors, they become dynamic building blocks—adaptable to changing markets, responsive to global shifts, and capable of driving real returns in even the most challenging environments.

For Belgian investors looking to future-proof their portfolios, commodities offer more than just protection—they offer potential. Whether through direct trading, ETFs, or multi-asset platforms, the tactical use of commodities can elevate an ordinary portfolio into one that is robust, responsive, and ready for what comes next.