Trading commodities is a dynamic and fascinating field that involves the buying and selling of raw materials, often referred to as commodities. These commodities range from agricultural products like wheat and coffee to energy resources like oil and natural gas. The commodity trading online market offers vast opportunities for investors, but it also comes with its fair share of risks. In this blog, we will explore the world of commodity trading in SA, the strategies for managing the associated risks effectively and trading safely with a commodity trading platform.

Overview Commodity Trading

What Are Commodities?

Before delving into the complexities of trading commodities, it’s essential to understand what commodities are. In simple terms, commodities are tangible goods that can be bought or sold primarily for consumption or production. These authentic goods can be categorised into two main types:

- Hard Commodities: These are natural resources extracted from the earth, including metals like gold, silver, and copper, as well as energy resources like crude oil and natural gas.

- Soft Commodities: These are typically agricultural products such as wheat, coffee, sugar, and cotton.

The Basics of Commodities Trading

Commodities trading involves the buying and selling of these tangible goods on various financial markets. The commodities are often traded as futures contracts, which obligate the buyer to purchase and the seller to sell the commodity at a predetermined price and date. This market is essential for producers and consumers to hedge against price volatility.

Commodities Trading Strategies

Commodities trading strategies vary, influenced by market conditions, trader preferences, and risk tolerance.

- Trend Following: Traders ride existing price trends, buying during upswings and selling during downswings to profit from momentum.

- Mean Reversion: Traders anticipate prices reverting to historical averages, buying low and selling high, counting on a return to the mean.

- Fundamental Analysis: This strategy assesses supply and demand fundamentals, along with global economic and political factors influencing trading decisions.

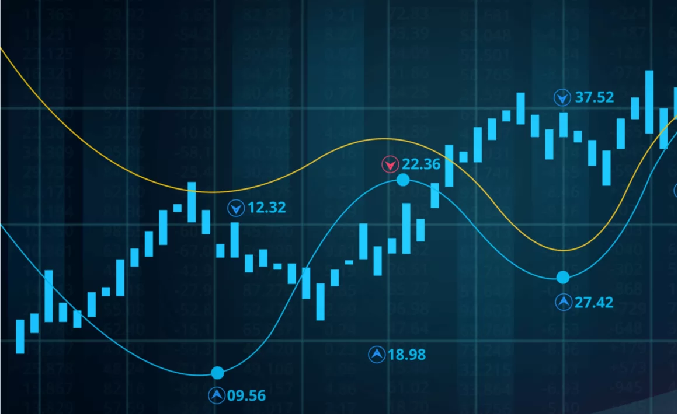

- Technical Analysis: Traders rely on charts, patterns, and historical data, employing indicators and tools to forecast future price movements.

Identifying and Assessing Risks in Commodity Trading

Trading commodities presents several inherent risks, and traders must identify and assess these risks before executing trades.

- Price Risk: Commodity prices can be highly volatile, subject to weather conditions, geopolitical events, and economic trends.

- Supply and Demand Risk: Changes in the supply and demand of commodities can impact prices. For example, a sudden drought can reduce the collection of agricultural commodities and drive prices higher.

- Liquidity Risk: Some commodities may have low trading volumes, making it difficult to buy or sell them at desired prices.

- Regulatory Risk: Government policies and regulations can significantly affect commodity markets, leading to price fluctuations.

- Credit Risk: When trading futures contracts, there is a risk of counterparty default. Traders need to be aware of the creditworthiness of their trading partners.

Risk Management Strategies

To mitigate the risks associated with commodities trading, traders can implement various risk management strategies.

- Diversification: Diversifying your portfolio by trading various commodities can help spread risk. A single adverse event affecting one commodity won’t have as significant an impact on your overall portfolio.

- Stop-Loss Orders: Setting stop-loss orders allows traders to define the maximum amount they will lose on a trade. If the price reaches that level, the trade is automatically closed.

- Hedging: Hedging involves taking an offsetting position to protect against price fluctuations. For example, producers may hedge their crop prices by selling futures contracts to lock in a favourable price.

- Risk Assessment: Continuously monitor and assess your risk exposure. Regularly reviewing your portfolio and risk tolerance can help you make informed decisions.

Managing Emotional and Psychological Risks

Emotional and psychological factors can also play a significant role in commodities trading. Traders often experience stress, fear, and greed, leading to irrational decision-making.

- Develop a Trading Plan: Create a well-defined trading plan that includes entry and exit strategies, risk management rules, and clear goals.

- Stick to Your Plan: Discipline is key. Avoid impulsive decisions and adhere to your trading plan, even when emotions run high.

- Continuous Learning: Stay informed and keep learning. The more you know, the more confident and less emotional your trading decisions will be.

- Manage Position Sizes: Avoid over-leveraging your positions, as this can magnify emotional reactions to market movements.

Trade Commodities Safely With a Commodity Trading Platform

A reliable commodity trading platform is your gateway to secure and efficient trading. These platforms offer real-time market data, user-friendly interfaces, and essential risk management features. Choosing the right platform, like Banxso, ensures a smoother trading experience and peace of mind when executing trades. Safety and reliability are paramount, so consider factors like customer support and platform stability when selecting. With the right online trading brokerage platform, you can navigate the complex world of commodities trading while keeping your investments safe.